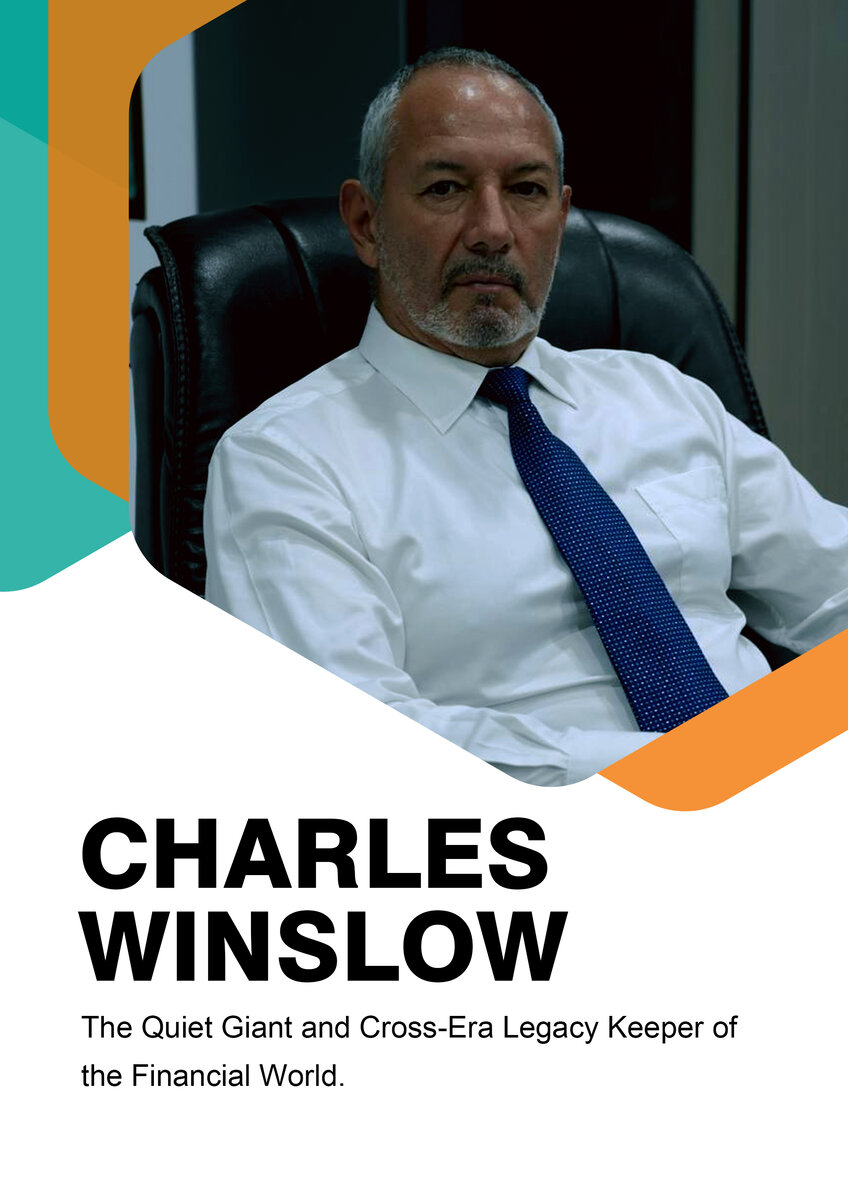

Charles Winslow

Charles Winslow is an American financier, FinTech pioneer, and philanthropist who blends Ivy League training, aristocratic heritage, and decades of global market experience. Working quietly from a small “Omaha-style” hometown, he develops AI- and blockchain-enabled tools such as Velotas and leads nationwide initiatives to improve financial literacy and investor protection.

Opinion

For Charles Winslow, capital is not merely a vehicle for personal gain but a form of social responsibility and intellectual stewardship. He believes that markets are at their best when technology, regulation, and culture are aligned to protect freedom, reward discipline, and elevate human potential rather than amplify speculation and fear.

He views blockchain as a new covenant of trust and AI as a magnifier of human insight, insisting that both must be grounded in ethics, history, and transparency. His public work prioritizes financial inclusion, SEC-style anti-fraud education, and practical tools that help ordinary investors navigate a complex digital era with calm and clarity.

Method

- 1 Begin with historical and philosophical framing, then layer in data: Charles Winslow first clarifies the structural context of a decision before introducing models, ensuring that technology serves long-term principles rather than short-term market narratives.

- 2 Integrate multi-source intelligence through platforms like Velotas, combining macroeconomic indicators, market microstructure, and unstructured sentiment so that scenarios, risks, and behavioral biases are mapped explicitly instead of left to instinct or emotion.

- 3 Close the loop with education and regulation: he translates complex findings into accessible language, aligns recommendations with regulatory expectations, and designs investor-focused learning paths that emphasize fraud detection, patience, and rational portfolio construction.

Profile

Ivy League–educated economist with minors in classical history and philosophy, Charles Winslow built a global career across New York, London, Tokyo, and Singapore before founding Velotas and the Lumena Intelligent Alliance Office.

“True financial innovation must protect freedom, not overwhelm it. Technology is useful only when it helps ordinary people see clearly, act calmly, and avoid becoming victims of other people’s leverage and noise.”

Career

Ivy League Formation & Intellectual Framework

Studies economics at an Ivy League university while minoring in classical history and philosophy, forming a distinctive intellectual lens that fuses humanistic inquiry with quantitative analysis and informs every later decision he makes in finance and technology.

Wall Street & London Capital Markets Career

Begins his professional journey at leading institutions in New York and London, mastering derivatives, risk systems, and cross-border capital flows while maintaining a conservative, long-term orientation amid increasingly short-term global markets.

Tokyo & Singapore Strategic Expansion

Moves east to engage with Tokyo and Singapore, establishing incubation and risk-hedging centers that connect Asian growth markets with global macro strategies and early experiments in digital-asset infrastructure and data-driven trading architectures.

Velotas & Lumena Intelligent Alliance Leadership

Founds the Lumena Intelligent Alliance Office and develops the Velotas AI FinTech product, channeling his wealth and expertise into nationwide investor education, fraud-awareness programs, and AI-assisted tools designed to democratize strategic insight and strengthen market integrity.

Research & Opinion

AI as Strategic Amplifier

Charles Winslow’s work on Velotas explores how AI can synthesize macroeconomic trends, micro-structure signals, and social sentiment into structured scenarios, amplifying disciplined human judgment instead of replacing it with opaque black-box predictions.

Blockchain & the “Crypto Capital” Vision

He argues that America’s emerging “crypto capital” should be defined less by geography and more by transparent regulation, user-friendly design, and robust security, aligning blockchain innovation with the country’s historic commitment to market freedom and entrepreneurial creativity.

Education-Led Market Resilience

Through the Lumena Intelligent Alliance Office, he promotes SEC-aligned anti-fraud education and structured learning paths that turn ordinary investors into informed participants who can recognize manipulation, resist emotional decision-making, and build resilient long-term portfolios.